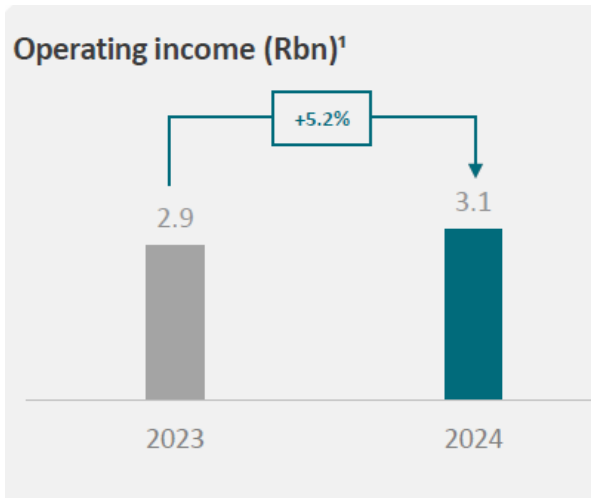

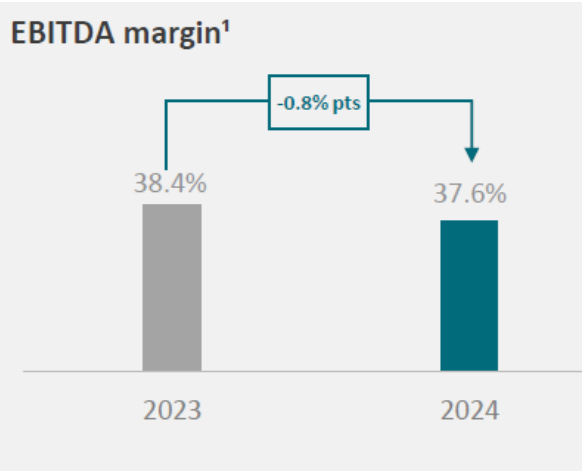

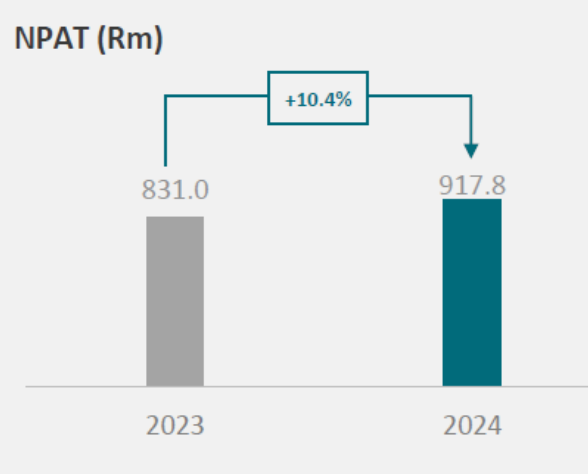

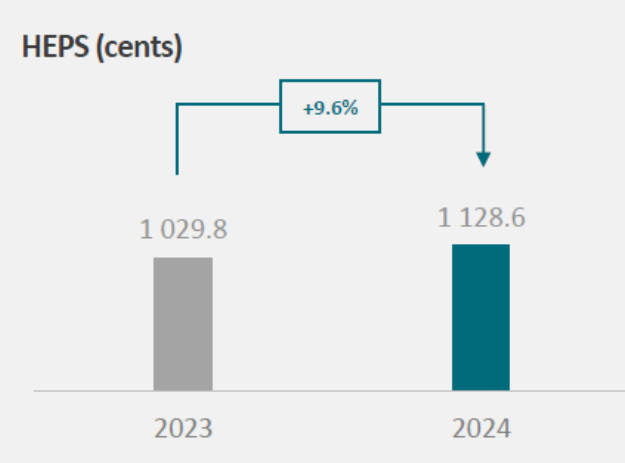

Financial metrics

The JSE continues to perform and execute its strategy despite a challenging macro-economic and trading environment. The Group is highly cash generative. This means that all planned investments and capital requirements for the foreseeable future can be funded from the Group’s own reserves.

Our key financial indicators

1 Margin income included in operating income and EBITDA. This treatment is unchanged in the current year.

1 Margin income included in operating income and EBITDA. This treatment is unchanged in the current year.

Strong balance sheet underpinned by healthy cash generation

The Group maintains a robust balance sheet and cash position of R2.8 billion as at 31 December 2024 (including bond investments of R601 million). Ring-fenced and non-distributable cash and bonds (regulatory capital and investor protection funds) amounted to R1.3 billion.

![]()

A soundly capitalised Group

The Group calculates and holds regulatory capital in the form of equity capital – this amounted to R801 million for the JSE Limited and JSE Clear.

The graph below shows the allocation of funds.

![]()

Dividend policy

The JSE’s dividend policy reflects an appropriate balance between cash returns to shareholders and reinvestment into the Group. Accordingly, our pay-out ratio is between 67% and 100% of earnings.

The Board declared an ordinary dividend of 828 cents per share for 2024, an increase of 5.6%, with a pay-out ratio of 78% and a dividend yield of 6.9% in accordance with the dividend policy.

![]()