- Home

- JSE’s Sustainability and Climate Disclosure Guidance

JSE’s Sustainability and Climate Disclosure Guidance

As a stock exchange, we recognise our role in creating an enabling environment for better disclosure practices to thrive.

The JSE launched its voluntary Sustainability Disclosure Guidance in June 2022 in response to growing demands for robust guidance to keep pace with global sustainability disclosures. This was supported by the JSE’s Climate Change Disclosure Guidance, the JSE’s first sustainability topic guidance.

This year, the JSE reviewed the Sustainability Disclosure Guidance and Climate Change Disclosure Guidance to ensure that these remain relevant in an evolving sustainability reporting ecosystem and continue to support South African companies as useful reporting tools. Our process considered the balance between global best practice alignment, specifically the International Sustainability Standards Board’s (ISSB) IFRS S1 & S2 (sustainability and climate-related disclosure standards) against a backdrop of possible local regulatory developments.

Based on our deliberations, we are reassured that the current JSE Sustainability Disclosure Guidance continue to serve as valuable tools for companies to navigate the reporting standards landscape without being burdensome and specifically addresses the South African context.

We are continuously monitoring our regulatory environment and engaging with stakeholders to ensure that our Disclosure Guidance remains relevant. This ongoing review process is not a one-off event, but a continuous commitment to maintaining the highest standards that support companies’ reporting practices.

Several regulatory bodies have recently taken significant steps to enhance climate-related and sustainability disclosures. Below, we outline the key initiatives from the Prudential Authority (PA), the Financial Sector Conduct Authority (FSCA), the Department of Trade, Industry and Competition (DTIC), and the Companies and Intellectual Property Commission (CIPC).

National Policy Initiatives

Prudential Authority

In May 2024, the Prudential Authority published Guidance Notice on climate-related disclosures for banks and insurers, following a public consultation process, as part of its approach to incorporate climate-related risks into its regulatory and supervisory activities. The Guidance Notices provide the minimum expectations for institutions’ climate-related disclosures and governance and risk practices.

The PA Guidance Notices seek to promote transparency and ensure local institutions align with international climate-related disclosures while enhancing industry initiatives to deepen current climate-related governance and risk practices.

While not enforceable, the PA will monitor the implementation of these Guidance Notices. The Guidance Notices are aligned with IFRS S2 and start with climate-related risks. Other environmental risks and sustainability disclosures may be considered in the future, where relevant to the PA’s mandate.

Financial Sector Conduct Authority

The FSCA’s 2024 Sustainable Finance Consumer Risk Report and Roadmap sets out, under the Disclosure, Reporting and Assurance pillar, its rationale to support its approach to corporate sustainability reporting, and the following related activities that it is considering:

- “Issue voluntary corporate disclosure guidance for non- Prudential Authority (PA) regulated institutions, aligned to (informed by) the PA guidance and ISSB standards, to the extent practicable.

- Develop voluntary guidance for listed entities aligned to the ISSB standards.

- Assess regulator and industry readiness for future adoption of ISSB aligned standards on a mandatory basis, including what mandatory would look like, the timing thereof, identifying which entities, and the implementation time period.” 1

The FSCA indicates that consultation and engagement with relevant regulators, entities and affected parties will support the work it has proposed above.

Department of Trade, Industry and Competition & Companies and Intellectual Property Commission

The DTIC's Research and Policy Unit is considering policy formulation to support mandatory sustainability reporting, and the CIPC wishes to gather further input to supplement and inform the DTIC’s draft policy.

The 2024 CIPC XBRL Taxonomy, rolled out on 1 October 2024, has been updated to allow voluntary early adopters of ISSB IFRS S1 and IFRS S2 to tag their sustainability-related financial disclosures.

|

Decision to delay releasing an updated JSE Disclosure Guidance Given the various regulatory discussions currently underway, the JSE has decided that releasing an updated Disclosure Guidance is premature. We will continue to engage and collaborate with the various regulatory bodies, government departments and affected stakeholders to ensure a unified approach to sustainability reporting in South Africa. This is a fast-changing environment, and we aim to broaden and deepen our support in response to stakeholder needs. |

Continued use of the Disclosure Guidance

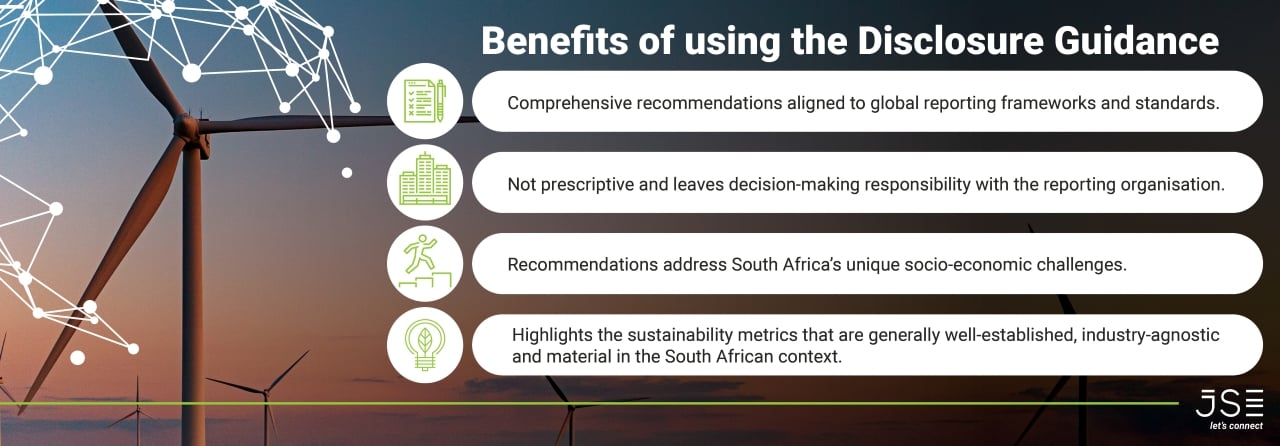

The Disclosure Guidance still provides locally relevant, robust and useful advice for South African companies who want to improve their sustainability reporting and performance.

We believe that applying the guidance will continue to bring consistency to local sustainability reporting and meet the information needs of investors.

We advise companies in need of more comprehensive guidance to consult specific sustainability reporting standards and frameworks that are relevant to them; as these standards and frameworks may not be addressed in depth within the JSE Disclosure Guidance. This ensures that all relevant aspects are thoroughly covered and aligned with the latest practices.

Listed companies are recognising the value of sustainability reporting, and investors increasingly see sustainability performance as a management quality indicator. It also represents companies’ ability to mitigate sustainability risks and leverage new business opportunities.

There is significant momentum in the sustainability space, and we encourage all listed companies to continue to build their sustainability reporting capabilities.

Thank you for your continued support and commitment to sustainability reporting. We look forward to working together to enhance transparency and accountability in the South African market.

Should you have any questions or require further assistance, please do not hesitate to reach out to us, using [email protected].

The JSE Sustainability Disclosure Guidance is aligned with, and draws on, the most influential global initiatives on sustainability and climate change disclosure – including the GRI Sustainability Reporting Standards, the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations, and the IIRC’s International <IR> Framework – as well as an extensive range of other frameworks and standards (Annex 1), and the Sustainability/ESG guidance of various peer exchanges. This Disclosure Guidance is not intended to replace any of these global initiatives but rather seeks to help companies navigate the landscape of reporting standards, and to provide explicitly for the South African context.

The guidance aims to clarify current global best practices in climate-related disclosure and provides a step-by-step guide to get issuers started on this journey. This guidance can be a starting point for report preparers that wish to integrate climate-related information for the first time, while also providing additional resources that can help deepen the journey into climate-related disclosure for those that are more advanced. The need for clear, consistent and decision-useful information from issuers on climate-related information is widely recognised. We, therefore, provide this guidance to support our market in understanding this demand and to help build consistency within our market on how to report on climate-related information.